Total Price: $0.00

Sales Tax Amount: $0.00

A Sales Tax Calculator is a useful tool that allows you to effortlessly determine the total cost of a purchase, including the sales tax. To begin with, you simply enter the purchase amount, which represents the cost of the item or service before any tax is applied. Next, you input the applicable sales tax rate, typically expressed as a percentage. Once these details are provided, the calculator swiftly computes the exact amount of sales tax that will be added to your purchase.

Moreover, the calculator doesn’t stop there. It automatically adds the calculated sales tax to the initial purchase amount, providing you with the final total cost. This feature is particularly beneficial as it eliminates the need for manual calculations, ensuring accuracy and saving time. For instance, if you purchase an item for $100 and the sales tax rate is 8%, the calculator will first calculate the sales tax, which amounts to $8. Subsequently, it will add this to the original price, resulting in a total cost of $108.

How to use our Sales tax calculator

Here we provide you instructions to use it easily. By following these steps, you can easily determine the total cost of any purchase, ensuring transparency and accuracy in your transactions. Whether you’re making a single purchase or managing multiple transactions, a sales tax calculator simplifies the process, providing peace of mind that you’re paying the correct amount. Follow these step-by-step guide

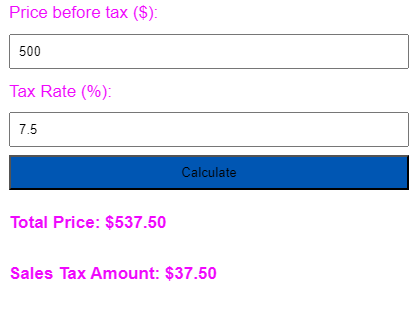

Step 1: Price Before Tax ($)

In the first step, you enter the price of the item or service before any taxes are applied. This is the initial cost, often referred to as the “sticker price” or “pre-tax price.” It’s crucial to ensure that this amount is accurate, as it forms the base for all subsequent calculations.

For example, if you’re buying a piece of furniture that costs $500, you would input “$500” as the price before tax. If there are any discounts or promotional offers, make sure to apply those first so that you enter the final discounted amount in this step.

Step 2: Tax Rate (%)

In the second step, you enter the applicable sales tax rate as a percentage. This rate varies depending on your location, as different states, cities, and even counties may have different tax rates. The tax rate is a critical factor because it determines how much extra you’ll pay on top of the original purchase price.

For example, if the sales tax rate in your area is 7.5%, you would input “7.5%” in this field. If you’re unsure of the exact rate, you might need to check local tax regulations or use a tool that can help you find the correct rate based on your location.

Step 3: Calculate

Once you’ve entered both the price before tax and the tax rate, it’s time to calculate the total cost. By clicking the “Calculate” button, the tool will automatically compute the amount of sales tax by multiplying the price before tax by the tax rate.

For example, if the price before tax is $500 and the tax rate is 7.5%, the calculator will multiply $500 by 0.075, resulting in $37.50 as the sales tax. The final step involves adding this sales tax to the original price, giving you a total cost of $537.50.

Importance and Application of a Sales Tax Calculator

Accuracy in Financial Planning: One of the primary benefits of using a sales tax calculator is the accuracy it provides in financial planning. Whether you’re an individual consumer or a business owner, knowing the exact amount of sales tax helps in budgeting and prevents unexpected expenses. For businesses, this accuracy is crucial in maintaining clear and precise financial records, which is essential for accounting and tax reporting purposes.

Time-Saving: Calculating sales tax manually can be time-consuming, especially when dealing with multiple items or varying tax rates across different regions. A sales tax calculator simplifies this process by providing instant results, saving valuable time, and reducing the risk of errors.

Transparency in Transactions: A sales tax calculator ensures transparency in financial transactions by breaking down the cost into the pre-tax price, sales tax, and total amount. This transparency is important for both consumers, who want to understand exactly what they’re paying for, and businesses, which need to provide clear invoices to their customers.

Compliance with Tax Laws: For businesses, it is vital to charge the correct amount of sales tax to comply with local, state, and federal tax laws. A sales tax calculator helps ensure that the correct rate is applied, thereby reducing the risk of undercharging or overcharging customers and avoiding potential legal issues.

Retail and E-commerce: In retail and e-commerce, a sales tax calculator is often integrated into the checkout process. It automatically calculates the correct sales tax based on the customer’s location and the total price of items in the cart. This feature is essential for providing customers with an accurate total before they complete their purchase.

Service Industry: Professionals and businesses in the service industry, such as contractors, consultants, and freelancers, use sales tax calculators to determine the appropriate sales tax on their services. This ensures that they charge their clients correctly and comply with tax regulations.

Hospitality and Travel: Hotels, restaurants, and travel agencies use sales tax calculators to determine the total cost of services, including room rates, meals, and travel packages. This application helps them provide clear pricing to customers and accurately report taxes.

Tax Preparation: During tax season, accountants and individuals preparing their tax returns use sales tax calculators to verify that they have paid or collected the correct amount of sales tax throughout the year. This application helps in identifying any discrepancies and ensures accurate tax filings.

Here’s a table that demonstrates how a sales tax calculator works with different purchase amounts and tax rates:

| Item Description | Price Before Tax ($) | Tax Rate (%) | Sales Tax ($) | Total Cost ($) |

|---|---|---|---|---|

| Laptop | 1,200.00 | 8.5 | 102.00 | 1,302.00 |

| Smartphone | 800.00 | 7.0 | 56.00 | 856.00 |

| Office Chair | 250.00 | 6.5 | 16.25 | 266.25 |

| Coffee Maker | 120.00 | 5.0 | 6.00 | 126.00 |

| Bookshelf | 180.00 | 9.0 | 16.20 | 196.20 |

| Headphones | 75.00 | 7.5 | 5.63 | 80.63 |

| Desk Lamp | 45.00 | 4.0 | 1.80 | 46.80 |

Explanation of the Table:

- Item Description: The type of item being purchased.

- Price Before Tax ($): The initial cost of the item before sales tax is applied.

- Tax Rate (%): The percentage of sales tax applicable based on location or product type.

- Sales Tax ($): The amount of tax calculated by multiplying the price before tax by the tax rate.

- Total Cost ($): The final price the customer pays, which is the sum of the price before tax and the sales tax.

For example, if you purchase a laptop priced at $1,200 with an 8.5% sales tax rate, the sales tax would be $102.00. Therefore, the total cost of the laptop would be $1,302.00.

In conclusion, a sales tax calculator is an essential tool that simplifies the process of determining the total cost of a purchase, including sales tax. By entering the price before tax and the applicable tax rate, the calculator provides instant and accurate results, ensuring transparency and compliance with tax laws. Whether you’re a consumer managing personal finances or a business owner handling transactions, this tool is invaluable for saving time, reducing errors, and maintaining clear financial records. Ultimately, a sales tax calculator enhances financial planning and ensures that both individuals and businesses can make informed and accurate financial decisions.

Disclaimer:

The sales tax calculations provided by this tool are for informational purposes only and should not be considered final or legally binding. Sales tax rates can vary by location, and additional factors such as discounts, exemptions, or special tax regulations may apply. It is recommended to verify the applicable tax rates with local authorities or consult with a tax professional to ensure accuracy in your financial transactions. The tool’s results are based on the information provided by the user, and the creators of this tool are not responsible for any discrepancies or financial decisions made based on its output.