Mortgage Recast Calculator

Mortgage Recast Results

Recast Mortgage Balance: $

New Monthly Payment: $

Total Number of Payments:

Start Date:

Payoff Date:

Total Interest Paid: $

Total Payment: $

Recasting Cost: $

Discover the Power of a Mortgage Recast Calculator

When you’re looking to optimize your mortgage payments, a Mortgage Recast Calculator becomes an invaluable tool. Firstly, this calculator helps you understand how making a lump-sum payment towards your mortgage principal can transform your loan. By inputting your current loan balance, interest rate, and remaining term, you can instantly see the impact of your extra payment. Moreover, once you enter the amount of your lump-sum payment, the calculator adjusts your loan details to show you the new monthly payment and potential changes in the loan term. Consequently, you gain a clear picture of how your financial strategy can lead to significant savings over the life of your mortgage.

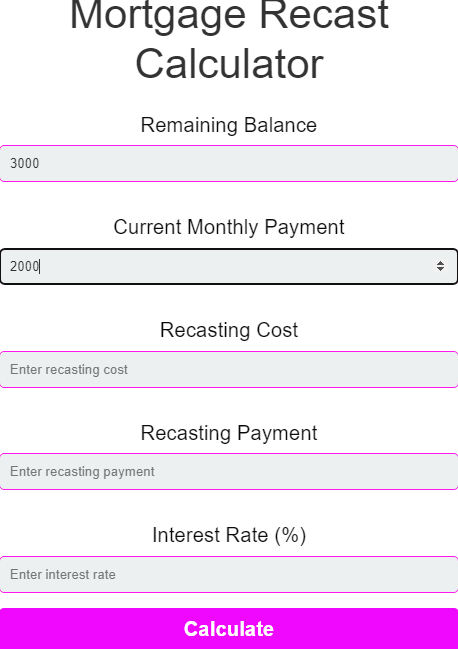

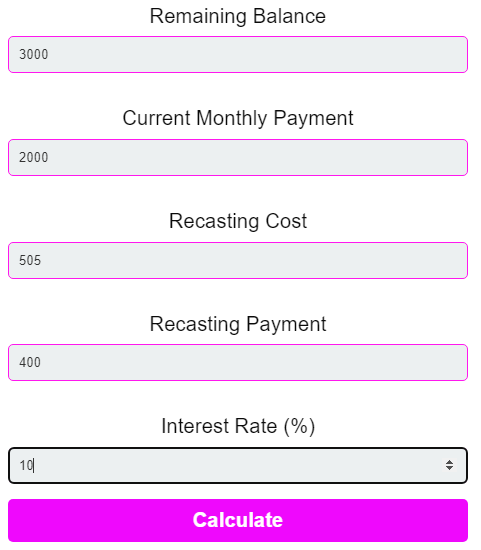

How to use our Mortgage Recast Calculator

Here we provide a step-by-step guide to work with our tool. This feature makes our tool unique and very easy to use for the user and also makes it user-interactive and attractive because this feature guides you in every step during calculation and avoids any mistakes. These features also provide instructions to use it. The usage instructions are below:

Step 1: Enter your Remaining Balance

It is the total amount still owed on your mortgage. Input the current outstanding balance of your mortgage loan into the calculator. This is the starting point for calculating how a lump-sum payment will affect your mortgage.

Step 2: Enter Your Current Monthly Payment

It Is the amount you pay each month towards your mortgage. You should enter your existing monthly payment(current monthly payment). This helps the calculator understand your current payment structure.

Step 3: Enter the Recasting Cost

It is the additional recurring cost payment you plan to make toward your mortgage. Input the amount of the lump-sum payment. This will reduce your principal balance and affect future payments.

Step 4: Enter Recasting Payment

It is the updated monthly payment amount after recasting your mortgage. The calculator will show you the new monthly payment based on the lump-sum payment and adjusted interest rate.

Step 5: Enter the Interest Rate (%)

It is the annual interest rate on your mortgage. Input your current interest rate. This allows the calculator to adjust for changes in your mortgage payments and interest accrual.

Step 6: Calculate

The process of generating your updated mortgage data. Click the “Calculate” button to see how the Recasting Cost affects your remaining balance, monthly payments, and overall loan term. The calculator will provide the adjusted monthly payment and any changes to your loan term and interest savings.

Application Areas of our tools

Financial Planning

Purpose: Helps homeowners plan their finances by showing how making a lump-sum payment will affect their mortgage payments and loan terms.

Use Case: If you receive a bonus, inheritance, or other windfall, you can use the calculator to see how paying down your mortgage early will impact your monthly budget and loan payoff schedule.

Purpose: Assists in managing and optimizing mortgage payments.

Use Case: Homeowners looking to reduce their monthly payments without refinancing can use the recast calculator to determine the effects of making a lump-sum payment.

Mortgage Management

- Debt Reduction Strategies

Purpose: Helps in planning strategies to reduce overall debt.

Use Case: For those aiming to pay off their mortgage faster, the calculator shows how a one-time principal payment can shorten the loan term and decrease the total interest paid.

Loan Restructuring

Purpose: Useful for restructuring existing loans.

Use Case: Homeowners considering a mortgage recast instead of refinancing can see how their monthly payments and loan terms will change, potentially avoiding the costs and complexity of refinancing.

Investment Decision-Making

Purpose: Aids in making informed investment decisions.

Use Case: When deciding whether to invest a lump-sum amount in your mortgage or in other investments, the calculator helps compare the benefits of reducing mortgage debt versus potential investment returns.

Budgeting and Forecasting

Purpose: Enhances budgeting and financial forecasting.

Use Case: Homeowners can forecast future monthly payments and plan their budget accordingly, considering how additional payments will affect their financial goals.

Understanding the Impact of Extra Payments

Purpose: Clarifies the impact of extra payments on the mortgage.

Use Case: If you’re contemplating making extra payments, the calculator provides a clear understanding of how these payments affect your loan balance and payment structure.

Conclusion

The Mortgage Recast Calculator is a valuable tool for estimating the impact of making a lump-sum payment on your mortgage. By providing insights into new loan balances, monthly payments, and potential savings, it helps you make more informed financial decisions. However, remember that the results are estimates and may differ based on your specific circumstances and lender policies. For personalized advice and accurate information, always consult a financial professional. Use this tool as a starting point to explore how recasting your mortgage could benefit you

Disclaimer

The Mortgage Recast Calculator is intended for informational purposes only and provides estimates based on user inputs. Results may vary and should not be considered accurate financial advice. The calculator does not reflect your lender’s terms or policies. Always consult with a qualified financial advisor or mortgage professional for precise information and advice. We are not responsible for any financial decisions made based on this tool.