Results

Monthly Payment:

Total Payment:

Total Interest:

A loan calculator is more than just a simple tool for calculating payments; instead, it serves as a powerful instrument for gaining a deeper understanding of how loans work and how they impact your financial future. By inputting variables like loan amount, interest rate, and term length, a loan calculator provides unique insights into the true cost of borrowing. Moreover, it breaks down your monthly payments, revealing how much goes toward interest versus principal, and helps you visualize the long-term financial commitment of a loan. Additionally, it allows you to experiment with different scenarios, such as varying interest rates or payment schedules, thereby enabling you to strategize and choose the most financially sound option. Ultimately, a loan calculator empowers you to make informed decisions, ensuring that your borrowing aligns with your financial goals and capabilities.

How to use our loan calculator tool

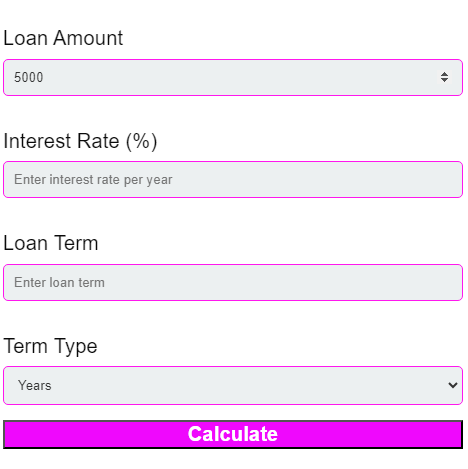

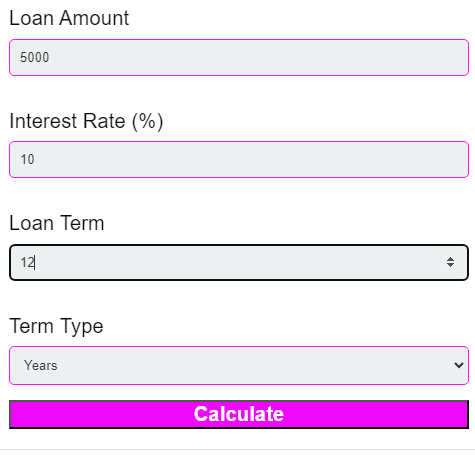

A loan calculator is a user-friendly financial tool that simplifies the process of estimating monthly loan payments and understanding the overall loan cost. It operates through an intuitive interface, typically featuring several buttons that correspond to key loan parameters. Here’s how it works in a unique, button-driven mode. Some buttons will be updated shortly. Here we provide you a step-by-step guide for your simple:

Loan Amount: you should enter a button labeled "Loan Amount" and input the total amount you plan to borrow. This is the principal amount required to finance the loan after accounting for any down payment or trade-in value.

Interest rate: By pressing the "Interest Rate" button, you should enter the annual percentage rate (APR) that the lender offers. Since this rate determines the cost of borrowing the loan amount, it is a crucial factor in calculating your monthly payments. Additionally, the calculator converts this annual rate into a monthly rate, ensuring more precise calculations.

Loan term: The "Loan Term" button allows you to specify the duration of the loan, typically in years or months. Consequently, choosing the right loan term can significantly impact your overall financial strategy.

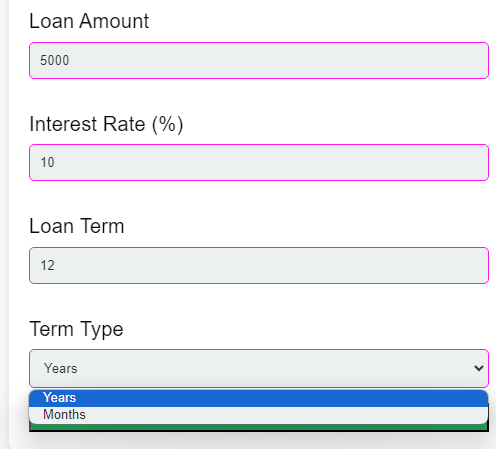

Term type: You can select the "Term Type" button to choose whether the loan term is expressed in months or years. This flexibility ensures that the calculator can accommodate various lender practices and user preferences.

Calculate: Once all relevant information is entered, you should press the "Calculate" button. Subsequently, the calculator processes the data using a mathematical formula that incorporates all the provided details. As a result, you receive an immediate display of the estimated monthly payment and the total interest cost over the loan term.

Benefits of using a loan calculator

A loan calculator offers several unique benefits that make financial planning easier. First, it provides a clear breakdown of your monthly payments and total interest costs, which helps you understand the true cost of borrowing. Additionally, it allows you to experiment with different loan scenarios, such as varying interest rates or terms, to find the most favorable option. Consequently, this flexibility enables you to tailor your loan to fit your budget and financial goals. Furthermore, by offering instant calculations, a loan calculator saves you time and reduces the complexity of loan management. Ultimately, it empowers you to make informed and strategic financial decisions.

Here are the unique Benefits of using a loan calculator presented point-wise:

Informed Decisions: It empowers you to make strategic financial decisions by providing a clear view of potential outcomes based on different loan configurations.

Clear Breakdown: It provides a detailed breakdown of your monthly payments and total interest costs, helping you understand the true cost of borrowing.

Scenario Analysis: You can experiment with different loan scenarios, such as varying interest rates or terms, to identify the most favorable option for your needs.

Budget Alignment: By offering flexibility in adjusting loan parameters, it helps tailor your loan to fit your budget and financial goals.

Time Efficiency: Instant calculations save you time and streamline the process of loan management, reducing complexity.

Here are some unique application areas for loan calculators:

- Personal Loans: By evaluating different loan amounts and terms, individuals can gain insights into how these factors affect their monthly payments and total costs.

- Mortgages: When considering home purchases, a loan calculator helps in comparing various mortgage options and their impacts on monthly payments and long-term financial commitments.

- Auto Loans: For those financing a vehicle, the calculator provides a clear picture of how different loan terms and interest rates influence monthly payments and overall costs.

- Student Loans: It offers students and graduates the ability to understand how different repayment plans affect their financial situation, helping them manage their education debt effectively.

- Debt Consolidation: By evaluating the terms of consolidating multiple debts into a single loan, the calculator assists in managing monthly payments and simplifying debt repayment.

- Business Loans: Entrepreneurs can use it to assess the financial implications of different loan options for funding their business needs, such as expansions or working capital.

- Refinancing: The calculator enables borrowers to explore the benefits of refinancing existing loans, such as lower interest rates or extended terms, thereby potentially reducing monthly payments and total interest.

Disclaimer: The information provided by this loan calculator is for illustrative purposes only and should not be considered financial or professional advice. The calculations are based on the data you input and the assumptions made, and actual loan terms, rates, and payments may vary. Please consult with a financial advisor or lender to obtain accurate information tailored to your specific situation. We do not guarantee the accuracy or completeness of the results and are not responsible for any financial decisions made based on the calculator's outputs.

Conclusion

In conclusion, a loan calculator is a valuable tool for simplifying financial decisions. By providing clear insights into monthly payments, total interest, and loan terms, it allows you to explore various scenarios and make informed choices. Consequently, using a loan calculator can help you manage your finances more effectively and plan your borrowing strategy with greater confidence.