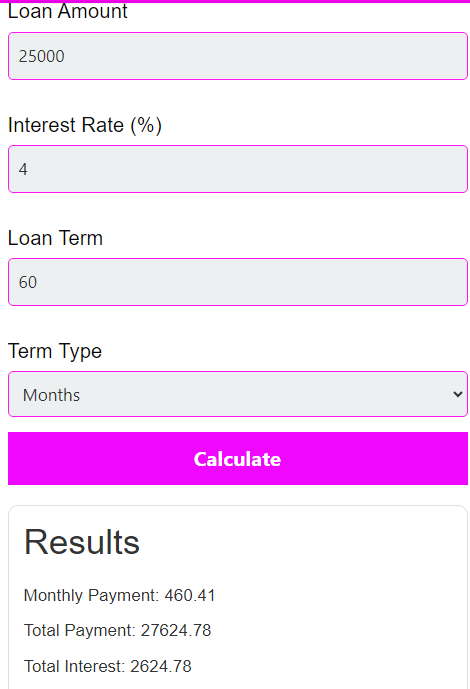

Results

Monthly Payment:

Total Payment:

Total Interest:

Are you dreaming of a new car but feeling overwhelmed by the complexities of auto loans? Our auto loan calculator is here to simplify the process and help you make informed decisions. In this blog post, we’ll guide you through using our calculator and explain how it can benefit you.

What is an auto loan calculator?

An auto loan calculator is a practical tool designed to help individuals estimate their monthly car payments based on several key factors such as the loan amount, interest rate, and loan term. By inputting these variables, the calculator provides a clear picture of the financial commitment involved in purchasing a vehicle through financing. It estimates monthly payments, helping users understand how much they will need to budget each month, and also calculates the total interest paid over the life of the loan, revealing the true cost of financing.

This tool is particularly useful for budget planning, ensuring that car payments fit within an individual's financial constraints without compromising other financial obligations. Additionally, it aids in comparing different financing options and loan terms, allowing users to negotiate better deals with lenders. By providing a comprehensive assessment of various scenarios, an auto loan calculator helps users make well-informed financial decisions, ensuring they choose a loan that best suits their needs and financial goals.

How to Use Our Auto Loan Calculator

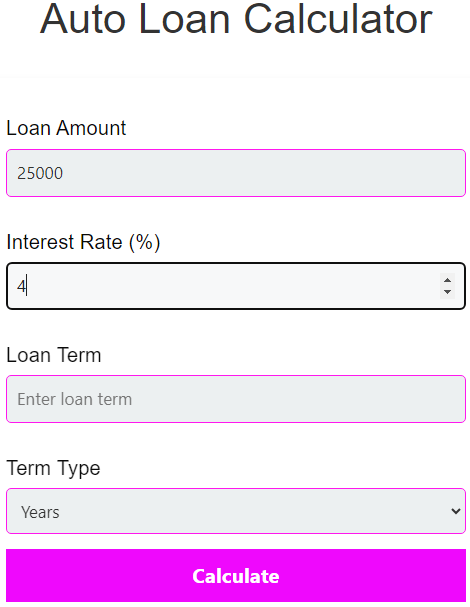

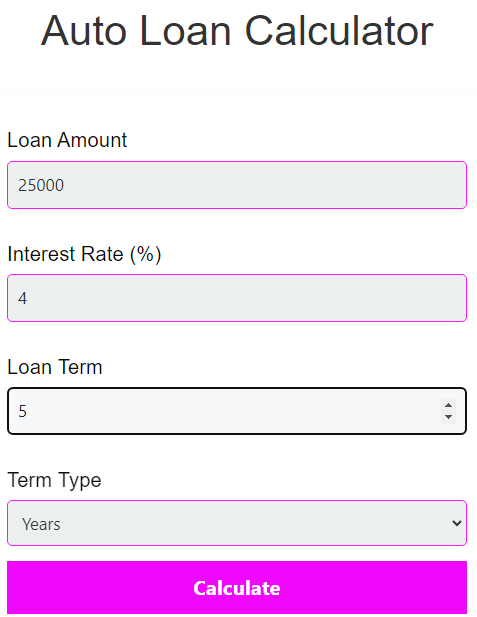

Using our auto loan calculator is straightforward. Here’s a step-by-step guide:

- Enter the Loan Amount: This is the total amount you plan to borrow. It typically includes the cost of the car minus any down payment. In fact, By clicking this button you should enter your loan amount.

Input the Interest Rate: This is the annual percentage rate (APR) that your lender charges. however, It’s a good idea to shop around for the best rate.

Choose the Loan Term: This is the length of time you have to repay the loan, usually expressed in months. Common terms range from 36 to 72 months.

Click ‘Calculate’: Once you’ve entered all the details, click the Calculate button. The calculator will display your estimated monthly payment.

Review and Adjust: Additionally, If the payment is higher than expected, you might want to adjust the loan amount, interest rate, or term to find a more manageable payment.

Why Use an Auto Loan Calculator?

- Understand Your Budget: Before you start car shopping, it's crucial to know how much you can afford. The calculator helps you determine a realistic monthly payment based on your budget.

- Compare Loan Options: With the calculator, you can compare different loan terms and interest rates to find the best deal for you.

- Plan for the Future: Knowing your monthly payment helps you plan your budget and manage your finances better, avoiding surprises down the road.

Example Calculation

Let’s say you want to buy a car for $25,000. You plan to make a $5,000 down payment, leaving a loan amount of $20,000. If you secure an interest rate of 4% for a 60-month term, our calculator will show you the monthly payment.

For this example, your estimated monthly payment would be around $368. Knowing this helps you understand how this loan fits into your budget.

Tips for Getting the Best Loan

- Improve Your Credit Score: A higher credit score often means a lower interest rate. Check your credit report and take steps to improve your score if needed.

- Compare Lenders: Don’t settle for the first loan offer. Compare rates from different lenders to find the best deal.

- Consider Your Down Payment: A larger down payment reduces the amount you need to borrow, which can lower your monthly payment.

- Check for Additional Fees: Be aware of any additional fees or charges that might affect your loan.

Key Features and Benefits of an Auto Loan Calculator:

- Loan Amount:

- The total amount borrowed to purchase the vehicle. This figure is typically the price of the car minus any down payment or trade-in value.

- Interest Rate:

- The annual percentage rate (APR) charged by the lender for borrowing the money. This rate can vary based on your credit score, the lender's policies, and current market conditions.

- Loan Term:

- The duration over which the loan will be repaid is usually expressed in months or years. Common terms range from 36 to 72 months, although shorter or longer terms may be available.

- Monthly Payments:

- The calculator provides an estimate of the amount you will need to pay each month to satisfy the loan based on the inputs provided. This helps you understand your monthly financial commitment.

- Total Interest Paid:

- In addition to calculating monthly payments, the calculator can show you the total amount of interest you will pay over the life of the loan. This is useful for understanding the true cost of financing your vehicle.

- Affordability Assessment:

- By inputting different scenarios, such as varying loan amounts, interest rates, or loan terms, you can determine what fits best within your budget. This can help prevent overextending your finances.

- Comparison Tool:

- It allows you to compare different financing options side-by-side. For example, you can see how a shorter loan term with a higher monthly payment compares to a longer term with lower monthly payments.

Practical Uses:

- Budget Planning:

- Ensures you can afford the vehicle without compromising your other financial obligations. It helps you see the impact of different loan terms and interest rates on your monthly budget.

- Negotiation Aid:

- Provides a solid foundation when negotiating loan terms with lenders. Knowing what to expect can help you secure better financing deals.

- Financial Forecasting:

- Assists in long-term financial planning by showing the total cost of the loan, including interest, helping you make informed decisions about your purchase.

By using an auto loan calculator, you can take control of your car-buying process, making sure you choose a loan that best suits your financial situation and goals.

Auto loan strategy:

Developing an effective auto loan strategy can help you secure the best possible terms for your car purchase, ensuring that you manage your finances wisely and minimize the total cost of the loan. Here are some key steps and considerations for a robust auto loan strategy:

Steps to a Successful Auto Loan Strategy:

- Assess Your Financial Situation:

- Budgeting: Determine how much you can afford to spend on a car without straining your finances. Consider all your monthly expenses and income to establish a realistic budget.

- Down Payment: Save for a substantial down payment. A larger down payment reduces the loan amount, lowers monthly payments, and can help you secure better interest rates.

- Check Your Credit Score:

- Credit Report: Obtain your credit report and check your credit score. A higher credit score typically qualifies you for lower interest rates, which can save you money over the life of the loan.

- Improve Your Credit: If your credit score is low, take steps to improve it before applying for a loan. Pay off outstanding debts, make timely payments, and avoid opening new credit accounts.

- Research and Compare Lenders:

- Shop Around: Don't settle for the first loan offer you receive. Compare rates and terms from different lenders, including banks, credit unions, and online lenders.

- Pre-Approval: Get pre-approved for a loan. Pre-approval gives you a clear idea of how much you can borrow and the interest rate you can expect, making the car-buying process smoother.

- Choose the Right Loan Term:

- Shorter vs. Longer Term: While a longer loan term can reduce your monthly payments, it usually results in paying more interest over the life of the loan. Aim for the shortest term that keeps payments manageable.

- Balance: Find a balance between a comfortable monthly payment and a reasonable loan term to minimize total interest costs.

- Negotiate Loan Terms:

- Interest Rate: Negotiate the interest rate with lenders. Even a small reduction in the rate can lead to significant savings.

- Fees: Be aware of any fees associated with the loan, such as origination fees or prepayment penalties, and negotiate to reduce or eliminate them.

- Use an Auto Loan Calculator:

- Estimate Payments: Use an auto loan calculator to estimate your monthly payments and total interest costs based on different loan amounts, interest rates, and terms.

- Scenario Planning: Experiment with various scenarios to find the optimal loan terms that fit your budget and financial goals.

- Read the Fine Print:

- Loan Agreement: Carefully review the loan agreement before signing. Ensure you understand all the terms and conditions, including interest rates, fees, and payment schedules.

- Hidden Costs: Watch for any hidden costs or clauses that could affect your loan, such as early repayment penalties.

Additional Tips:

- Avoid Unnecessary Add-Ons: Dealers may offer additional products like extended warranties, GAP insurance, or maintenance plans. Evaluate these carefully and avoid unnecessary add-ons that can increase your loan amount.

- Consider Refinancing: If interest rates drop or your credit score improves after you secure your loan, consider refinancing to obtain a lower rate and reduce your monthly payments or total interest paid.

By following these steps and being proactive in managing your auto loan, you can secure favorable terms and ensure that your car purchase aligns with your long-term financial strategy.

Conclusion

Our auto loan calculator is a powerful tool that makes it easier to understand your financing options and manage your car budget. By following the steps outlined above, you can make more informed decisions and find a loan that fits your financial situation. Happy car shopping!

If you have any questions or need assistance, feel free to reach out to our support team. We’re here to help you drive away in your new car with confidence!