Mortgage Calculator

Monthly Payment (Before Tax): $0.00

Monthly Payment (After Tax): $0.00

Introduction

When it comes to purchasing a home, a mortgage is often the most significant financial commitment you’ll make in your lifetime. Whether you’re a first-time homebuyer or looking to refinance, understanding your mortgage options and how much you can afford is crucial. This is where a mortgage calculator becomes an invaluable tool. In this guide, we’ll explore everything you need to know about mortgage calculators—what they are, how to use them, and why they are essential in the home-buying process.

What is a mortgage calculator?

A mortgage calculator is an online tool that helps you estimate your monthly mortgage payments based on several variables such as the loan amount, interest rate, loan term, and down payment. These calculators are designed to simplify the complex calculations involved in determining your mortgage payments and provide a clearer picture of your financial obligations.

Why Use a mortgage calculator?

Mortgage calculators are beneficial for several reasons:

- Financial Planning: They help you understand how much house you can afford based on your current financial situation.

- Budgeting: By knowing your potential monthly payments, you can budget accordingly and avoid overcommitting.

- Comparative Analysis: Mortgage calculators allow you to compare different loan scenarios, such as varying interest rates or loan terms.

- Decision-Making: They empower you to make informed decisions about refinancing, prepayments, or adjusting your loan terms.

Now, let’s dive into the specifics of how mortgage calculators work and what you need to know to use them effectively.

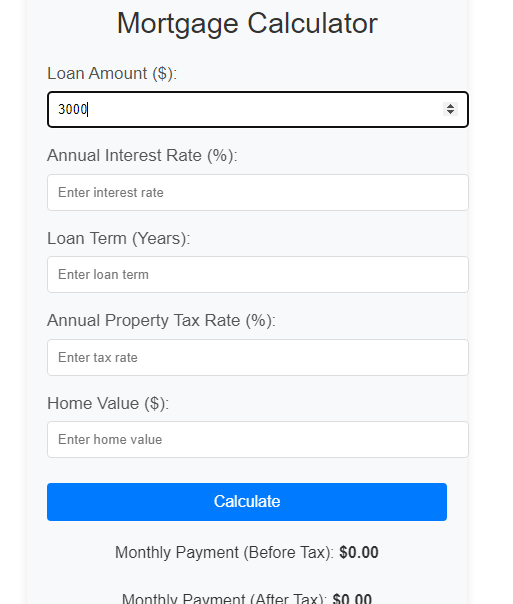

Step 1:Enter Loan Amount ($):

Input the total amount of money you plan to borrow. This is the principal amount of your loan, which will be used to calculate your monthly payments and total interest.

Step 2:Enter Annual Interest Rate (%):

Specify the annual interest rate for your loan. This percentage represents how much interest will be charged on the loan amount each year.

Step 3:Enter Loan Term (Years):

Indicate the number of years over which you will repay the loan. This determines the duration of your loan and impacts your monthly payment amount.

Step 4:Enter Annual Property Tax Rate (%):

Provide the annual property tax rate for your home. This rate will be used to calculate the yearly property tax amount based on the value of your home.

Step 5:Enter Home Value ($):

Input the current market value of your home. This value is needed to calculate the annual property tax based on the tax rate provided.

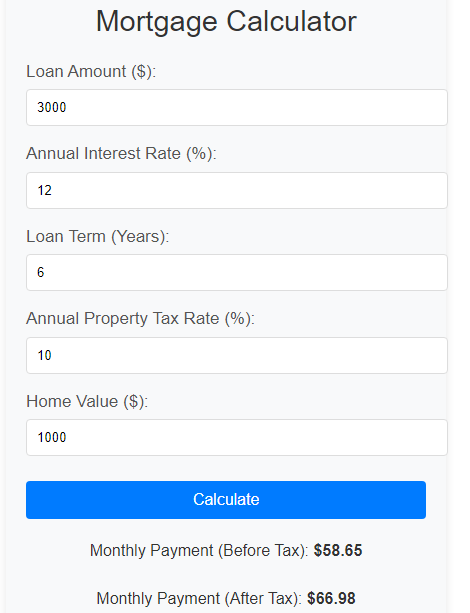

Step 6 : Click “Calculate”:

After entering all the required information, click the “Calculate” button. This will process the data and provide you with the following results:

Monthly Loan Payment: The amount you will pay each month towards repaying your loan.

Total Interest Paid: The total amount of interest you will pay over the life of the loan.

Annual Property Tax: The total amount of property tax you will need to pay each year based on the home value and tax rate.

Understanding the Key Components of Mortgage Calculators

To effectively use a mortgage calculator, it’s crucial to understand the key components that influence your mortgage payments. Here’s a breakdown of the main factors:

1. Loan Amount

The loan amount is the total sum of money you borrow from a lender to purchase a home. This amount is typically the price of the home minus your down payment. The loan amount significantly impacts your monthly mortgage payments—the higher the loan, the higher the payment.

2. Interest Rate

The interest rate is the percentage charged by the lender on the amount borrowed. It can be fixed or variable:

- Fixed-Rate Mortgages: The interest rate remains constant throughout the loan term.

- Variable-Rate Mortgages: The interest rate can change periodically based on market conditions.

The interest rate is one of the most critical factors affecting your mortgage payment and the total cost of the loan.

3. Loan Term

The loan term is the duration over which you agree to repay the loan. Common mortgage terms are 15, 20, or 30 years. A shorter loan term typically results in higher monthly payments but lower overall interest costs, while a longer term means lower monthly payments but more paid in interest over time.

4. Down Payment

The down payment is the initial payment you make when purchasing a home, typically expressed as a percentage of the purchase price. A larger down payment reduces the loan amount, potentially lowering your monthly payments and the overall cost of the loan.

5. Property Taxes and Homeowner’s Insurance

While not part of the loan itself, property taxes and homeowner’s insurance are often included in your monthly mortgage payment. These are usually collected through an escrow account managed by your lender.

6. Private Mortgage Insurance (PMI)

If your down payment is less than 20% of the home’s purchase price, you may be required to pay Private Mortgage Insurance (PMI), which protects the lender in case you default on the loan. PMI can significantly increase your monthly payments.

7. Amortization Schedule

An amortization schedule is a table detailing each periodic payment on an amortizing loan. It shows how much of each payment goes toward interest and how much toward the principal balance, providing a roadmap of how your loan will be paid off over time.

Types of Mortgage Calculators and Their Uses

There are several types of mortgage calculators, each designed for specific purposes. Here’s a look at the most common types:

1. Basic Mortgage Payment Calculator

The basic mortgage payment calculator helps you determine your monthly payment based on the loan amount, interest rate, and loan term. It’s the most straightforward tool and is ideal for getting a quick estimate of your payments.

2. Advanced Mortgage Calculator

An advanced mortgage calculator includes additional variables such as property taxes, homeowner’s insurance, and PMI. It provides a more comprehensive picture of your total monthly payment.

3. Refinance Calculator

A refinance calculator helps you understand the potential savings or costs associated with refinancing your mortgage. It takes into account your current loan details and the new loan’s terms to determine if refinancing is financially beneficial.

4. Amortization Calculator

An amortization calculator provides a detailed breakdown of each payment over the life of the loan. It shows how much of each payment goes toward principal versus interest and how the loan balance decreases over time.

5. Affordability Calculator

An affordability calculator helps you determine how much house you can afford based on your income, debts, and other financial obligations. It considers various factors, including down payment, interest rate, and loan term.

6. Interest-Only Mortgage Calculator

An interest-only mortgage calculator is designed for loans where you only pay the interest for a set period. This calculator helps you understand how your payments will change once you start paying down the principal.

How to Use a Mortgage Calculator Effectively

Using a mortgage calculator effectively requires understanding your financial situation and the details of the loan you’re considering. Here’s a step-by-step guide to using a mortgage calculator:

Gather Your Financial Information

Before using a mortgage calculator, gather all relevant financial information, including your income, debts, credit score, and details about the home you want to purchase. This information will help you input accurate data into the calculator.

Input the Required Data

Enter the following information into the mortgage calculator:

- Loan Amount: The amount you plan to borrow.

- Interest Rate: The annual interest rate of the loan.

- Loan Term: The number of years over which you will repay the loan.

- Down Payment: The amount of money you will put down upfront.

Adjust for Additional Costs

If you’re using an advanced calculator, input additional costs such as:

- Property Taxes: Enter the annual property tax amount.

- Homeowner’s Insurance: Input the annual cost of homeowner’s insurance.

- PMI: If applicable, input the monthly PMI payment.

Review the Results

Once you’ve entered all the information, review the results. The calculator will provide your estimated monthly payment, including principal, interest, taxes, insurance, and PMI (if applicable).

Compare Different Scenarios

To get a comprehensive understanding, use the calculator to compare different scenarios. For example, see how different down payment amounts, interest rates, or loan terms affect your monthly payment and total loan cost.

Factors That Influence Your Mortgage Payments

Several factors influence your mortgage payments, and understanding them can help you make better financial decisions. Here are some of the most significant factors:

1. Credit Score

Your credit score is one of the most critical factors in determining your interest rate. A higher credit score can lead to a lower interest rate, reducing your monthly payment and the overall cost of the loan.

2. Debt-to-Income Ratio (DTI)

Lenders use your debt-to-income ratio (DTI) to assess your ability to manage monthly payments and repay debts. A lower DTI can improve your chances of getting a better interest rate.

3. Interest Rate Type

The type of interest rate—fixed or variable—can significantly affect your payments. A fixed-rate mortgage provides stability with consistent payments, while a variable-rate mortgage can fluctuate, affecting your budget.

4. Loan Type

Different types of loans (conventional, FHA, VA, USDA) have different requirements, interest rates, and costs. It’s essential to understand the specific terms and conditions of the loan you choose.

5. Prepayment Penalties

Some loans have prepayment penalties for paying off the loan early. Make sure to consider this when calculating potential savings from making extra payments or refinancing.

6. Market Conditions

Interest rates are influenced by broader market conditions, including economic growth, inflation, and Federal Reserve policies. Staying informed about market trends can help you decide when to lock in a rate.

Tips for Reducing Your Mortgage Payments

If you’re looking to reduce your mortgage payments, consider the following strategies:

1. Improve Your Credit Score

A higher credit score can qualify you for a lower interest rate, reducing your monthly payments. Paying down debt, making timely payments, and correcting any errors on your credit report can help boost your score.

2. Increase Your Down Payment

A larger down payment reduces the loan amount, which can lower your monthly payments and eliminate the need for PMI if you put down at least 20%.

3. Opt for a Longer Loan Term

While this increases the total interest paid over time, extending your loan term can reduce your monthly payments, making them more manageable.

Conclusion

By entering the requested information and clicking “Calculate,” you will receive an estimate of your monthly loan payments, total interest paid over the life of the loan, and annual property tax. This will help you understand the financial aspects of your loan and budget accordingly.

Disclaimer

Please note: The results provided by this calculator are estimates and should not be considered as financial advice. The actual loan terms, monthly payments, interest rates, and property taxes may vary based on factors such as credit score, lender policies, and changes in tax rates. For precise calculations and financial advice, please consult with a financial advisor or loan specialist. This calculator does not account for other costs such as insurance, maintenance, or fluctuations in interest rates